If I were to walk into a room of one hundred small business owners and ask how many of them love their job, I’m willing to bet the majority would say, “Heck, yeah!” If I brought up payroll… the room might be a bit quieter.

Maybe they forgot running their dream job included complicated payroll processes. Perhaps you did, too?

You might not have started your salon with the dream of running payroll, but it’s necessary if you want to keep the lights on and employees at their stations. If you find that running payroll for your salon adds stress to your life and drags you away from the floor more than you’d like, you have come to the right place.

This post will give you tips to manage salon payroll like a pro… without burning the midnight oil.

The Unique Challenges of Salon Payroll

Any business has some level of risk attached. You can’t control outside forces. You can’t help it if a customer is having a bad day and takes it out on you. You can’t control the weather stopping clients from reaching their appointments.

But you are in control of your management system. If you started your business as a labor of love, you might not have realized how complex managing tasks like marketing, hiring and scheduling employees, and payroll can be. You have unique challenges to navigate.

Every business wants more revenue. And it’s not just down to you to generate revenue. You might have stylists who work on commission, who you compensate for bringing in business. You might also have self-employed stylists who rent a booth from you.

Lastly, you need to consider whether employees are paid by salary, wage, commission, and a combination of these!

Since your salon has so many moving parts, you’ll need to stay on top of bookkeeping and cash flow. Can you outsource payroll? Would a payroll provider take some of the stress away? Short answer, yes. For now, let’s look at three tips you can take action on today!

1. Establish Employee Classifications

The first thing you need to do when managing payroll is to classify workers, whether they’re salaried or self-employed, correctly. It will blow back on you if you misclassify employees.

Firstly, suppose you misclassify an employee as self-employed. In that case, the IRS might hold you liable for employment taxes for the entire time you have a misclassified contractor working for you, plus penalties. Secondly, your employee could sue you as an employer.

What are the IRS Rules for Classification?

Generally, employees are classified as W-2. Self-employed individuals are classified as 1099.

If a salon technician is 1099, they have more control over their behavior, bring their own tools, and aren’t subject to performance reviews. Financially, a 1099 employee isn’t reimbursed for business expenses, and they determine when and how they get paid. They aren’t entitled to benefits.

If a salon technician is an employee or W-2, you can tell them which tools to use and when, run performance reviews, and determine how to pay them for their work. W-2 employees are entitled to benefits.

How to Manage Classification

Make sure you know the rules. You’re not saving money on payroll taxes by misclassifying employees as self-employed. You’re setting yourself up for audits, fines, and penalties.

Self-employed technicians and stylists:

- Use their own equipment

- Is paid on a job-by-job basis

- Sets their own schedule

- Is free to accept other jobs from multiple clients

- Doesn’t have to comply with training and uniform rules or sign non-compete agreements.

If any of these don’t ring true, your technician or stylist is an employee.

2. Go Mobile

To keep up with the growing need for convenience, you must invest in the mobile experience. A payroll app allows your employees to access their information on their phones and saves paper. You’ll save time not needing to prepare and deliver checks. You’ll pay employees on time and eliminate the need to store and organize paper payroll records.

Salon employees are more likely to have irregular or differing schedules. Mobile apps that allow remote access to staff schedules are a big plus. You can easily manage shift changes, time tracking, and communication with your employees.

Lastly, employees will thank you for fast access to their documentation and pay stubs. They can access their tax documentation, W-2s, pay stub history, and earned wage access. If they’re trying to buy a car and asked for paystub verification, they can whip out their phone, access the app, and show their pay stubs to the salesperson instead of needing to ask HR.

3. Get Connected

It can feel overwhelming to manage the day-to-day management of your salon. If the classification of employees feels like a weight on your shoulders and managing payroll feels cumbersome, it might be time to connect with payroll providers who can help.

Payroll services can connect you with your area’s tax experts and workers’ compensation specialists. They can help you decide how you should classify workers, whether you should change your business model, and how to navigate payroll and payroll schedules, taxes, and benefits.

Use a software solution to keep things organized and simple. The best salon payroll tools save you time, reduce errors, automate payroll, and automatically process tax filings.

Related: Payrolling Services: What They Are and Why You Need Them

Manage Salon Payroll Without Pulling Your Hair Out

These three tips should help you get off to a great start with your salon payroll management processes. However, to truly master your payroll, these four tips are only the beginning.

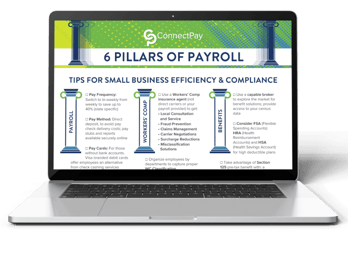

Payroll entails more than pay schedules and pay stubs. To manage payroll properly, you must also be prepared to navigate payroll taxes, Workers’ Compensation, and more.

If you feel overwhelmed just thinking about managing all this on your own, you’re not alone! At ConnectPay, we partner with small business owners working through the challenges of payroll management every day.

That is why we have created our free resource, the Connected Guide to Small Business Payroll. Check out this free resource today to get actionable tips for managing your payroll the easy way.