Dealing with taxes and payroll compliance takes time and focus away from growing your company. But what if you could hand that task off to a trusted partner?

If that sounds like your dream scenario, you need custom payroll services. These providers handle all the number crunching, tax payments, filings, and more so you can get back to doing what you love. And with the right partner, you get tailored solutions that meet your small business's unique needs. But how do you find the best partner for your business?

In this article, we’ll break down the basics of custom payroll services, from what they are to top factors in choosing a provider. You’ll walk away with clarity on the value of outsourcing payroll and tips for picking the perfect partner for your growing company.

The Basics of Custom Payroll Services

Before we dive in, what exactly are payroll service providers? Payroll service providers are companies that offer comprehensive payroll processing, tax filing, and related services to companies of all sizes.

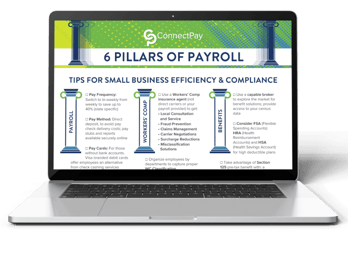

Working with a small-business-focused payroll provider like ConnectPay can help you save time and resources by automating critical tasks like calculating employee compensation, withholding taxes, preparing checks or direct deposits, and even filing taxes.

There are two main types of payroll service providers you might consider as small business owners:

- Professional Employer Organizations (PEOs) are companies that take over a business's employment tax payments and tax return filing and ensure proper tax deposits.

- Payroll Service Providers (PSPs) help businesses meet their obligations to file and deposit taxes with the IRS and state authorities. PSPs also print checks, make direct deposits, and provide other necessary payroll-related services.

Many companies opt to use payroll service providers to simplify payroll administration and save time and money compared to traditional manual processes. The payroll process is highly complex and involves ever-changing regulations, so payroll service providers offer their expertise to ensure businesses remain compliant without any hassle.

These providers also often offer user-friendly tools to simplify payroll tasks like setting up direct deposits or pay cards, providing employee portals, and handling electronic tax filings and payments.

At ConnectPay, our transparent pricing has no hidden fees or budget surprises. Our team of dedicated Payroll Specialists will help you run payroll on your own, or process payroll for you.

Whether you’re just getting started with payroll, or are making the switch to our service from another provider, our Dedicated Onboarding Team can get you up on our platform quickly and efficiently.

When you choose to work with our team, you’ll see the benefits of:

- Our ‘No Voicemail Guarantee’ during business hours–you’ll talk to us, not a chatbot

- Access to convenient time & attendance tools to make time-tracking easy for you and for your employees

- Our HR Resource Center–full of compliance tools and a live telephone hotline connecting you to industry experts when and if you have pertinent HR-related questions

- Recommendations within our Connected Payroll network for trusted, local experts in accounting, HR services, employee benefits, bookkeeping, and retirement savings to support your business as you grows

What Separates Custom Payroll Services From Custom Payroll Software?

Payroll Services

Custom payroll service providers handle your entire payroll process, including performing wage calculations, submitting tax payments, managing tax filings, and updating employee data. They provide personalized service and support as needed via phone or email. These providers stay current on evolving tax laws and regulations so you can focus on managing your business rather than administrative tasks like payroll.

Some providers, like ConnectPay, even offer ongoing education and support. When you choose a provider with these offerings, you can lean on their team to learn how to process payroll yourself using the provider’s online portal. Our ‘No Voicemail Guarantee’ ensures you’ll always speak with a live Payroll Specialist during business hours to answer any questions that come up while you’re running payroll.

Payroll Software

Custom payroll software helps calculate payroll and taxes, but it requires input and maintenance of employee data, managing tax deposits and filings, and overseeing employee payments. Your team needs to dedicate time to setting up and running payroll cycles, providing internal support, and keeping up with evolving laws.

5 Considerations When Choosing Your Custom Payroll Services Partner

Convinced that partnering with a custom payroll service provider is the right option for your small business? Here are five things to keep in mind as you consider potential options:

1. Service Support

Pick a provider offering support options that align with your business's operations, like phone or email. Ask specific questions upfront about how easy it is to set up their service and what service availability looks like. Be sure to validate that dedicated support will be accessible during your peak operating hours as issues arise. Consider posing questions like:

- If I run into an issue or have a question about payroll, how quickly can you resolve it?

- Is there access to a live payroll specialist during the work day, or will I be waiting in a service queue and talking to a chatbot?

You can prevent frustration down the line by setting clear expectations around onboarding complexity and support response times. The right partner should communicate expectations, timelines, and have reasonable guarantees backed by dedicated teams.

Pro tip: Many providers make guarantees that they never follow through on. Take your research a step further and check out reviews on Google or Trustpilot to verify that these companies' promises are true.

2. Integrations and Security

When considering payroll providers, make sure they can integrate with your software tools, employ data safety measures, and notify you in the event of a data breach. Select a partner who prioritizes integration flexibility and data security to protect your systems and employee information.

3. Business Reputation

You want to ensure that your payroll runs smoothly, so it’s essential to validate that your chosen payroll provider is a reliable and stable industry player. Thoroughly review independent reviews and try to get third-party feedback on overall customer satisfaction levels. Try to get insight into how any issues, big or small, have been handled.

An established payroll provider with proven expertise and happy customers means less risk of business disruption for your organization. This upfront investment in research can communicate a lot about how much you can trust them as a long-term payroll partner.

4. Features and Capabilities

To run your payroll smoothly, evaluate must-have features and capabilities for now and the future. How can you ensure the solution you select has your dream features list?

Start by listing everything you need, beginning with core requirements and branching out to include the “nice to have” features. Don’t forget about your goals for the future as well. Are you looking to grow? Hire seasonal employees? Mention these factors to make sure you’re finding a provider who can manage all that you’re looking for.

Once you’ve established your list of dealbreakers when it comes to features, find a provider that meets your core needs, can help you scale up as you grow, and is generally flexible. Your ideal business partner should have a vested interest in your growth.

5. Accessibility

Finally, evaluate the accessibility of services provided by various potential providers. Compare the total costs and consider them with the level of partnership you need. For instance, local payroll firms may offer more personalized support, while national ones may provide streamlined efficiencies through technology. Consider which type of payroll relationship and experience would be best for your company.

The ideal provider should be affordable while still providing the expertise your business needs. Consider ConnectPay’s payroll software solution to see if our features match your business’s needs. Our payroll software, Relay, is trusted by thousands of small businesses! Watch the Relay demo to see how we can meet your payroll and HR needs.

Your Next Step Towards Custom Payroll Services

Knowing the type of partner you want that provides the level of service, security, and accessibility your business needs is just the first step toward getting your custom payroll services up and running.

If you don’t have the time or desire to weed through countless payroll providers to find the best fit for your small business, we can help. Curious about what ConnectPay can do for your business? Schedule your free Payroll Tax and Compliance Review today.

We’ll discuss your biggest payroll pitfalls and provide suggestions and solutions. Are you ready to simplify payroll?