The benefits of QuickBooks Online best practices include:

- Safe, clean company data files.

- Accurate reports offering insight into your finances.

- Saving time executing tasks.

- Better relationships with customers and vendors.

Do you use any or all of the following best practices in your business?

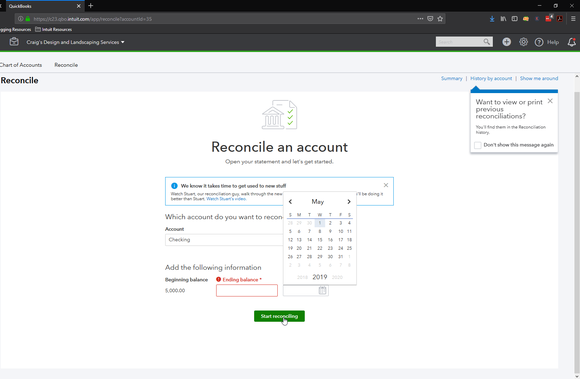

1. Regulary Reconcile Accounts

QuickBooks Online can connect to your financial institution’s websites and download cleared transactions. It also has ways to keep your accounts reconciled online, like you used to do every month when your paper statement arrived. Reconciliation processes help you uncover errors. You gain a clearer picture of your cash flow, and reporting accuracy and timing are improved when you reconcile consistently.

Although it can be a tedious process, your books will thank you for regularly reconciling your accounts in QuickBooks Online.

2. Clean Up Your Lists

Large lists can affect your experience working in QuickBooks Online, as well as your operational efficiency. When you first started using QuickBooks Online, your lists may have been short, but, over time, may have grown and become more difficult to manage. To hehp clean up lists, make your list elements inactive, instead of deleting them.

3. Secure Your QuickBooks Online Workspace

Ensure that the password you create for your sign-in ID is in accordance with secure password guidelines and that it’s something you can easily recall. This also extends to team members who use your same QuickBooks Online file.

You want to prevent unauthorized access to your workspace, or worse, fraudulent actions within the transactional chain of events. Securing your online workspace will preserve the integrity of the information in QuickBooks Online, making your reporting data accurate.

4. Keep Track of 1099 Vendors

No matter how many vendors you work with, you are bound to have at least one using IRS Form 1099, about the same time you’re preparing W-2s for employees. These 1099-related tasks become easier if those individuals and companies are earmarked. If you think vendors might need 1099s when you create their records in QuickBooks Online, click in the box to the left of Track payments for 1099 in the lower right corner.

5. Properly Categorize Transactions with QuickBooks Online Class Tracking

When utilizing categories (for example, Classes, Customers and Vendors, Territories) within transactions, make sure you’ve assigned each the correct classification. Errors in these categories not only can result in problems with daily workflow, but also affect the accuracy of your reports. As a related best practice, create a meaningful group of Classes and use them faithfully. They’ll help you make better business decisions. Ask your CPA to help you categorize your account – it will make things much easier for everyone come tax season!

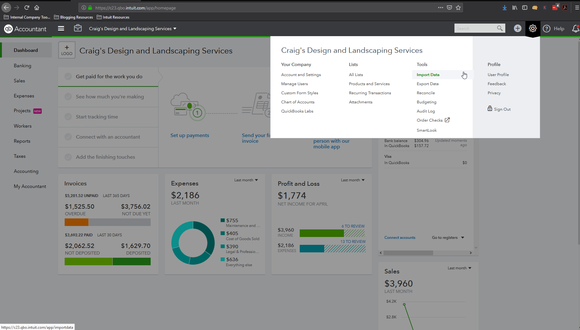

To create your list of Classes, click the gear icon in the upper right and select All Lists | Classes | New.

6. Monitor Your QuickBooks Online Reports Regularly

QuickBooks Online gives you advanced reports you should be creating for yourself regularly — monthly or quarterly. Such reports include Profit and Loss, Balance Sheet, and Statement of Cash Flows. The mechanics of creating them aren’t difficult, but understanding how to analyze them is. You should be running reports on your own at frequencies that you think would be helpful, like A/R Aging Detail, Unpaid Bills, and Sales by Class Detail.

Following best practices with QuickBooks Online will boost your efficiency and may just save you money, too.