Payroll can be a headache. Between employees questioning every hour deduction or forgetting to submit timecards–you can easily spend hours verifying details, crunching numbers, scheduling payments, and triple-checking bank accounts and deposit dates.

What ends up happening is that, instead of focusing your time and energy on running the business you love, you end up wrestling with payroll processes that grind progress to a halt as you untangle time card messes and put out direct deposit fires.

Securing the best payroll company for your very small business doesn't just save you time. It ensures payroll runs accurately and seamlessly — every time.

In this article, we'll cover the top five solutions so you can get back to the passion that started your company and leave the payroll headaches behind.

Finding the Best Payroll Company For Very Small Business: First Things First

When selecting the best payroll company for very small businesses, it is crucial to partner with a provider that understands compliance always comes first. Your payroll provider should be able to handle automated tax payments and filings, assist you in case of an audit, and help you avoid any corrections or penalties.

You should also consider which payroll features are essential for your business, both in the present and the future. These features may include direct deposit, overtime calculations, benefits integrations, or scheduling. Even though you’re a very small business, compare pricing and fees across setup costs, monthly charges, and per-employee rates to find an affordable option that fits your budget.

As a small business owner, you may be used to handling payroll on your own. But if you want to find a solution that can adapt to your business's growth, look for user-friendly platforms with phone and email support that can quickly address any questions you may have.

Let’s take a look at 5 of the best payroll providers for tiny, but mighty small businesses.

Best Payroll Company For Very Small Businesses: 5 Top Options and Benefits

-

ConnectPay

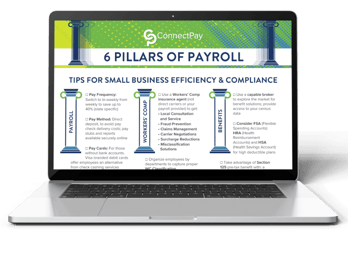

At ConnectPay, we specialize in simplified small-business-focused payroll processing and support. Key advantages of our payroll software include our user-friendly platform (which makes managing payroll easy without needing expert-level knowledge), which is backed by our industry-known dedicated customer service. When we’re here, we answer the phone.

During business hours, you’ll never get our voicemail or a chatbot. We understand the need for direct, quick support when it comes to navigating payroll questions. Our Dedicated Onboarding Team can help you make the switch to our service or get acclimated with managed payroll for the very first time.

One happy user shares:

“ConnectPay has provided me with great service for almost 10 years! Liz is always so nice and helpful with anything that my company needs. I would highly recommend them.”

-

Paychex Flex

Paychex Flex is a good option if you're looking for an advanced payroll solution that provides in-depth data and visualizations. Their analytics dashboard provides customizable, real-time payroll spending metrics–giving you complete transparency into where your money is going.

In addition to basic payroll services, Paychex Flex centralizes Human Resources and offers robust tax tools with automated calculations. It's also compatible with over 350 integrated services, like accounting, benefits managers, and time trackers.

Pricing is available on a per-case basis, so reach out to their team for more information.

-

Intuit/Quickbooks

QuickBooks Online Payroll is a platform designed for small business owners who are comfortable using technology and want to process payroll on their own. Intuit offers different packages based on your needs: a basic plan for running automated payrolls, a premium plan including inventory management and 1099 contractor management, and an elite plan with guided support.

Additionally, their payroll solutions are integrated into their QuickBooks Accounting software, making it an affordable option for companies that might struggle with paying for multiple software.

-

Gusto

Gusto is a good choice for small businesses that want to manage payroll online without the need for long-term contracts. It offers flexible plans that allow you to either run payroll alone (or opt for more comprehensive plans that include HR services).

Gusto excels at tax registration, making it a great fit for businesses with remote employees in the United States. It also offers support for international contractor payments, which is perfect if your business outsources a lot of work overseas.

However, some user reviews share that Gusto is a DIY payroll solution, which means you'll be handling most of the work yourself if you choose this option. Plans start at $40 monthly, plus an additional fee per user, and go up from there.

-

Work with a Local CPA

Chances are, you might already be working with a local CPA. Many of them run payroll for their small business clients. As your company grows, an experienced CPA may recommend transitioning to a full-service payroll company if you outgrow their capacity.

Some key indicators that it might be time to level up your CPA services include implementing systems for robust timekeeping, setting up 401(k)’s or medical plans, or needing multi-state tax filings.

If you feel like your business is hitting this threshold, we can connect you with a local, qualified CPA ready to assist you with specific federal or local compliance requirements for your very small business.

Choosing the Best Payroll Company For Very Small Business

While each of these five solutions offers unique advantages, finding the best payroll company for very small business depends on your business’s specific needs.

If you want a payroll solution specifically designed to personally serve small business owners like you, we’re here to help! Our experience and dedicated support can ensure you have all the information and context you need to run payroll confidently each cycle.

Curious about what we can do for your business? Schedule your free Payroll Tax and Compliance Review today!